Leading zinc producers curb production as energy costs have risen enormously.

While a surplus was initially assumed for 2021, demand ultimately exceeded supply when the year as a whole is considered. High energy prices are making the production of zinc unprofitable in some cases, as zinc production is very energy intensive. The supply situation is therefore tight. In January 2022, the zinc price has firmed up. News of production line closures or cutbacks has already been increasing since the third quarter of 2021, for example in Europe. It is estimated that smelter capacities of around 595,000 tons of zinc have been shut down across Europe in recent months. Further production declines are imminent.

Glencore, for example, announced in November 2021 that it would put lead-zinc production in Italy, at Portovesme, on hold. Zinc producer Nyrstar is doing the same in France, Auby. Two other Nyrstar production sites in Europe are cutting production in half. Caused by high energy prices, losses have to be averted and zinc prices are therefore expected to rise. Added to this is the problem of supply chains that are not running perfectly. In addition, there is the risk that the Portovesme and Auby smelters will remain idle for a longer period. At the same time, the International Lead and Zinc Study Group forecasts that global demand for refined zinc will rise to 14.09 million tons this year and 14.41 million tons in 2023. So that’s the time to look at zinc companies, even though refinery shutdowns could lead to more hesitant declines in crude production at times. In the long term, the outlook seems very good. That’s where companies like Griffin Mining and Osisko Metals come in.

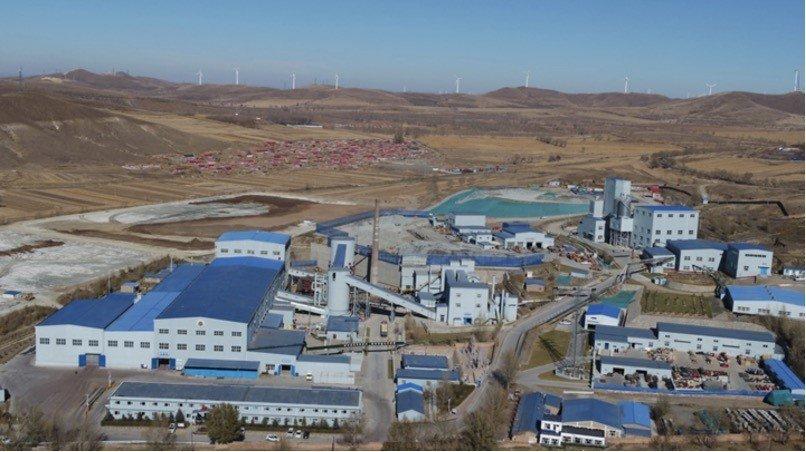

Griffin Mining – https://www.youtube.com/watch?v=7uFCyHCv-zs – has an 88.8 percent stake in the producing Caijiaying zinc-gold mine in China, making it China’s largest zinc producer.

Osisko Metals – https://www.youtube.com/watch?v=_znAPvgkYvM – takes care of base metals and controls the large Pine Point zinc mining area in the Northwest Territories.

Current corporate information and press releases from Griffin Mining (- https://www.resource-capital.ch/en/companies/griffin-mining-ltd/ -) and Osisko Metals (- https://www.resource-capital.ch/en/companies/osisko-metals-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()