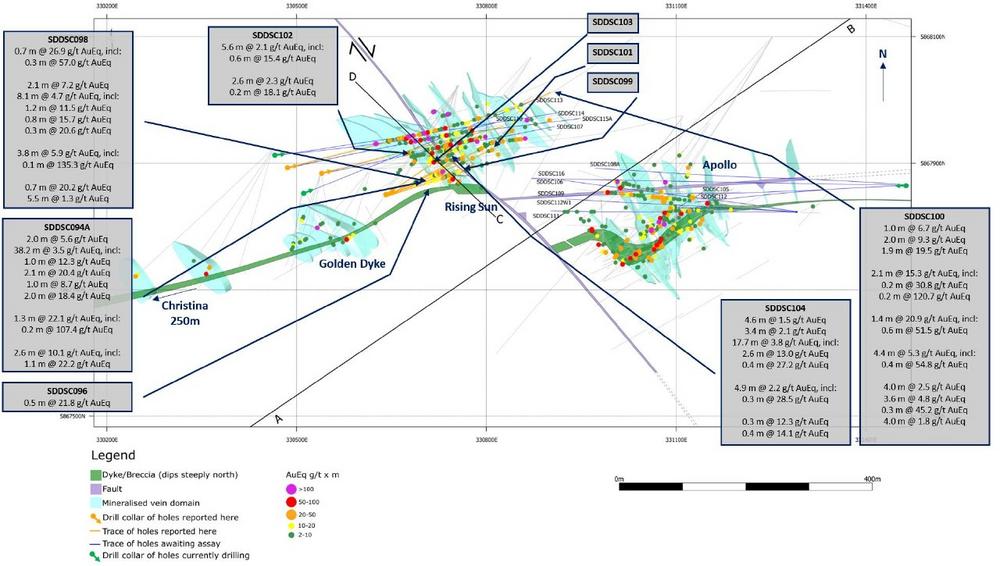

• Release of data from nine drillholes (SDDSC094A, 96, 98-104) that further enhance confidence and demonstrate continuity to near surface levels within the Rising Sun area. Notably, four of nine holes reported contain downhole cumulative intervals of > 100 g/t AuEq x metres.

• SDDSC094A was drilled through the upper zone of Rising Sun, from the hanging wall position and at a high angle to mineralized vein sets. The hole traversed four high-grade vein sets (Figures 1 and 2) including the discovery of one new vein set. Selected highlights include:

o 2.0 m @ 5.6 g/t AuEq (5.5 g/t Au, 0.1% Sb) from 144.0 m

o 38.2 m @ 3.5 g/t AuEq1 (2.5 g/t Au, 0.6% Sb) from 152.0 m, including:

▪ 1.0 m @ 12.3 g/t AuEq (11.3 g/t Au, 0.6% Sb) from 161.0 m

▪ 2.1 m @ 20.4 g/t AuEq (19.6 g/t Au, 0.5% Sb) from 167.9 m

▪ 7.4 m @ 7.0 g/t AuEq (3.1 g/t Au, 2.4% Sb) from 179.0 m (vein RS10, see Figure 3)

▪ 2.0 m @ 18.4 g/t AuEq (6.7 g/t Au, 7.4% Sb) from 184.4 m

o 1.3 m @ 22.1 g/t AuEq (13.0 g/t Au, 5.8% Sb) from 277.3 m (new vein discovery)

o 2.6 m @ 10.1 g/t AuEq (9.3 g/t Au, 0.5% Sb) from 338.2 m

• SDDSC098 drilled 25 m to 60 m below SDDSC094 also traversed four high-grade vein sets, highlights include:

o 0.7 m @ 26.9 g/t AuEq (17.9 g/t Au, 5.7% Sb) from 125.3 m

o 2.1 m @ 7.2 g/t AuEq (3.9 g/t Au, 2.1% Sb) from 132.8 m

o 8.1 m @ 4.7 g/t AuEq (1.8 g/t Au, 1.8% Sb) from 147.1 m

o 3.8 m @ 5.9 g/t AuEq (3.9 g/t Au, 1.3% Sb) from 162.5 m

o 0.7 m @ 20.2 g/t AuEq (20.1 g/t Au, 0.0% Sb) from 187.3 m

• SDDSC100 intersected eleven vein sets over 430 vertical m. It was drilled through the lower zone of Rising Sun, located 90 m and 70 m up and down dip respectively from high-grade intervals within SDDSC082 and SDDSC077B (Figure 3). Highlights included:

o 2.0 m @ 9.3 g/t AuEq (7.7 g/t Au, 1.1% Sb) from 453.0 m

o 1.9 m @ 19.5 g/t AuEq (16.8 g/t Au, 1.7% Sb) from 469.0 m

o 1.4 m @ 26.6 g/t AuEq (22.8 g/t Au, 2.4% Sb) from 469.5 m

o 2.1 m @ 15.3 g/t AuEq (7.5 g/t Au, 4.9% Sb) from 487.4 m (vein RS10, see Figure 3)

o 1.4 m @ 20.9 g/t AuEq (20.5 g/t Au, 0.2% Sb) from 507.6 m

o 4.4 m @ 5.3 g/t AuEq (4.9 g/t Au, 0.3% Sb) from 737.3 m

o 3.6 m @ 4.8 g/t AuEq (4.8 g/t Au, 0.0% Sb) from 849.6 m

• SDDSC104 was drilled from the southern margin of the host sequence, intersected the host lower in the hole and four mineralized vein sets. Highlights included:

o 17.7 m @ 3.8 g/t AuEq (2.3 g/t Au, 0.9% Sb) from 438.0 m

• Mawson owns 93,750,000 shares of SXG (51%), valuing its stake at A$107.3 million (C$93.8 million) based on SXG’s closing price on February 8, 2024 AEST.

Michael Hudson, Mawson Interim CEO and Executive Chairman, states: “These holes provide the critical elements to drill out a mineralized body as we keep on demonstrating continuity and predictability of gold-antimony mineralization. Completed as drill fans starting at the upper Rising Sun area and going to depth, they fill in large gaps in an up- and down-dip sense as well as testing the strike extension of the mineralized vein sets. They increase our confidence in the geological model and demonstrate the continuity that supports the <2.0 coefficient of variation of our assay data within modelled veins that our geostatistics provides.”

Drill Hole Discussion

The holes reported can be separated into two areas: Rising Sun Upper and Rising Sun Lower.

Rising Sun Upper

SDDSC094A (cumulative 199 g/t AuEq x m @ 2 m @ 1g/t AuEq lower cut) and SDDSC098 (cumulative 134 g/t AuEq x m) showed continuity of high grades to near surface levels (from 70 m vertically below surface).

The two drill holes intersected four mineralized vein sets each which provided key infill points and assist in the definition of a new vein set at Rising Sun, named RS35 (1.3 m @ 22.1 g/t AuEq (13.0 g/t Au, 5.8% Sb) from 277.3 m in SDDSC094A and 1.5 m @ 1.1 g/t AuEq (1.1 g/t Au, 0.0% Sb) from 241.1 m in SDDSC098.

Highlights for SDDSC094A included:

• 2.0 m @ 5.6 g/t AuEq (5.5 g/t Au, 0.1% Sb) from 144.0 m

• 38.2 m @ 3.5 g/t AuEq1 (2.5 g/t Au, 0.6% Sb)1 from 152.0 m, including:

o 1.0m @ 12.3 g/t AuEq (11.3 g/t Au, 0.6% Sb) from 161.0 m

o 2.1 m @ 20.4 g/t AuEq (19.6 g/t Au, 0.5% Sb) from 167.9 m

o 7.4 m @ 7.0 g/t AuEq (3.1 g/t Au, 2.4% Sb) from 179.0 m (vein RS10, see Figure 3)

o 2.0 m @ 18.4 g/t AuEq (6.7 g/t Au, 7.4% Sb) from 184.4 m

• 1.3 m @ 22.1 g/t AuEq (13.0 g/t Au, 5.8% Sb) from 277.3 m (new vein set), including:

o 0.2 m @ 107.4 g/t AuEq (59.2 g/t Au, 30.5% Sb) from 277.9 m

• 2.6 m @ 10.1 g/t AuEq (9.3 g/t Au, 0.5% Sb) from 338.2 m, including:

o 1.1m @ 22.2 g/t AuEq (20.3 g/t Au, 1.2% Sb) from 338.2 m

Highlights for SDDSC098 included:

• 0.7 m @ 26.9 g/t AuEq (17.9 g/t Au, 5.7% Sb) from 125.3 m, including:

o 0.3 m @ 57.0 g/t AuEq (37.7 g/t Au, 12.2% Sb) from 125.7 m

• 2.1 m @ 7.2 g/t AuEq (3.9 g/t Au, 2.1% Sb) from 132.8 m

• 8.1 m @ 4.7 g/t AuEq (1.8 g/t Au, 1.8% Sb) from 147.1 m, including:

o 1.2 m @ 11.5 g/t AuEq (4.1 g/t Au, 4.7% Sb) from 147.6 m

o 0.8 m @ 15.7 g/t AuEq (5.2 g/t Au, 6.7% Sb) from 150.5 m

o 0.3 m @ 20.6 g/t AuEq (3.0 g/t Au, 11.2% Sb) from 154.3 m

• 3.8 m @ 5.9 g/t AuEq (3.9 g/t Au, 1.3% Sb) from 162.5 m, including:

o 0.1m @ 135.3 g/t AuEq (96.0 g/t Au, 24.9% Sb) from 166.1 m

• 0.7 m @ 20.2 g/t AuEq (20.1 g/t Au, 0.0% Sb) from 187.3 m

• 5.5 m @ 1.3 g/t AuEq (1.2 g/t Au, 0.0% Sb) from 211.0 m

SDDSC096 (cumulative 13 g/t AuEq x m) with a highlight of 0.5 m @ 21.8 g/t AuEq (21.8 g/t Au, 0.0% Sb) from 120.8 m and SDDSC099 (cumulative 10 g/t AuEq x m) were drilled at too high an intersection angle across the mineralized host horizon, and therefore passed from the hangingwall to the footwall of the mineralized host too rapidly and remained in unaltered sediment until end of hole (Figures 1 and 2).

SDDSC101 and SDDSC103 were drilled 20 m to 30 m north of the host horizon and did not contain mineralization. They define the northern mineralization boundary in the western portion of Rising Sun Upper and provide further structural information in the hanging wall (Figures 1 and 2).

Rising Sun Lower

SDDSC100 (cumulative 236 g/t AuEq x m) was drilled through the lower zone of Rising Sun, demonstrating up and down dip continuity between high-grade intervals intercepted in SDDSC082 and 77B (released 23 October 2023 and 5 September 2023, respectively). The hole was drilled 80 m to 180 m down dip from SDDSC077B and 7 m to 160 m up dip from SDDSC082 (Figure 3) and provides critical infill points to confirm continuity of eleven vein sets over 430 vertical m. Selected highlights included:

• 1.0 m @ 6.7 g/t AuEq (4.9 g/t Au, 1.1% Sb) from 390.0 m

• 2.0 m @ 9.3 g/t AuEq (7.7 g/t Au, 1.1% Sb) from 453.0 m

• 1.9 m @ 19.5 g/t AuEq (16.8 g/t Au, 1.7% Sb) from 469.0 m

• 2.1 m @ 15.3 g/t AuEq (7.5 g/t Au, 4.9% Sb) from 487.4 m (vein RS10, see figure 3), including:

o 0.2 m @ 30.8 g/t AuEq (9.8 g/t Au, 13.3% Sb) from 487.4 m,

o 0.2 m @ 120.7 g/t AuEq (62.9 g/t Au, 36.6% Sb) from 489.3 m

• 1.4 m @ 20.9 g/t AuEq (20.5 g/t Au, 0.2% Sb) from 507.6 m

• 4.4 m @ 5.3 g/t AuEq (4.9 g/t Au, 0.3% Sb) from 737.3 m, including:

o 0.4 m @ 54.8 g/t AuEq (50.7 g/t Au, 2.6% Sb) from 739.4 m

• 4.0 m @ 2.5 g/t AuEq (2.3 g/t Au, 0.1% Sb) from 779.0 m, including:

o 1.0 m @ 6.8 g/t AuEq (6.8 g/t Au, 0.0% Sb) from 779.0 m

• 3.6 m @ 4.8 g/t AuEq (4.8 g/t Au, 0.0% Sb) from 849.6 m, including:

o 0.7 m @ 10.4 g/t AuEq (10.4 g/t Au, 0.0% Sb) from 850.3 m

o 1.2 m @ 8.4 g/t AuEq (8.4 g/t Au, 0.0% Sb) from 852.0 m

• 0.3 m @ 45.2 g/t AuEq (45.2 g/t Au, 0.0% Sb) from 891.6 m

• 4.0 m @ 1.8 g/t AuEq (1.7 g/t Au, 0.0% Sb) from 911.0 m

SDDSC102 (cumulative 35 g/t AuEq x m) and SDDSC104 (cumulative 115 g/t AuEq x m) drilled from the southern margin of the host sequence, intersected the host lower in each hole and five and four vein sets respectively.

Highlights for SDDSC102 included:

• 5.6 m @ 2.1 g/t AuEq (2.0 g/t Au, 0.1% Sb) from 419.3 m, including:

o 0.6 m @ 15.4 g/t AuEq (15.3 g/t Au, 0.0% Sb) from 419.3 m

• 2.6 m @ 2.3 g/t AuEq (2.2 g/t Au, 0.1% Sb) from 478.4 m

• 0.2 m @ 18.1 g/t AuEq (16.6 g/t Au, 1.0% Sb) from 495.0 m

Highlights for SDDSC104 included:

• 4.6 m @ 1.5 g/t AuEq (1.5 g/t Au, 0.0% Sb) from 140.0 m

• 3.4 m @ 2.1 g/t AuEq (1.0 g/t Au, 0.7% Sb) from 431.7 m

• 17.7 m @ 3.8 g/t AuEq (2.3 g/t Au, 0.9% Sb) from 438.0 m, including:

o 2.6 m @ 13.0 g/t AuEq (5.5 g/t Au, 4.7% Sb) from 442.7 m

o 0.4 m @ 27.2 g/t AuEq (20.6 g/t Au, 4.2% Sb) from 454.9 m

• 4.9 m @ 2.2 g/t AuEq (1.9 g/t Au, 0.2% Sb) from 462.0 m, including:

o 0.3 m @ 28.5 g/t AuEq (27.7 g/t Au, 0.5% Sb) from 466.6 m

• 0.3 m @ 12.3 g/t AuEq (12.3 g/t Au, 0.0% Sb) from 471.3 m

• 0.4 m @ 14.1 g/t AuEq (13.8 g/t Au, 0.2% Sb) from 486.1 m

Pending Results and Update

Ten holes (SDDSC0105 – 107, 108A, 109-112, 112W1, 114) are currently being processed and analyzed, with three holes (SDDSC113, 115A, 116) currently in progress (Figures 1-2). Southern Cross Gold has stated that it anticipates drilling an additional 19,000 m by April 2024.

Further discussion and analysis of the Sunday Creek project by Southern Cross Gold is available on the SXG website at www.southerncrossgold.com.au.

No upper gold grade cut is applied in the averaging and intervals are reported as drill thickness. During future Mineral Resource studies, the requirement for assay top cutting will be assessed.

Figures 1-5 show project location, plan, longitudinal and cross-sectional views of drill results reported here and Tables 1–3 provide collar and assay data. The true thickness of the mineralised intervals reported are interpreted to be approximately 50% to 60% of the sampled thickness for other reported holes. Lower grades were cut at 1.0 g/t Au lower cutoff over a maximum width of 2 m with higher grades cut at 5.0 g/t Au lower cutoff over a maximum of 1 m width, unless otherwise1 stated (0.3 g/t Au lower cutoff over a maximum width of 3 m).

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services (“On Site”) which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

MAW considers that both gold and antimony that are included in the gold equivalent calculation (“AuEq") have reasonable potential to be recovered at Sunday Creek, given current geochemical understanding, historic production statistics and geologically analogous mining operations. Historically, ore from Sunday Creek was treated onsite or shipped to the Costerfield mine, located 54 km to the northwest of the project, for processing during WW1. The Costerfield mine corridor, now owned by Mandalay Resources Ltd contains two million ounces of equivalent gold (Mandalay Q3 2021 Results), and in 2020 was the sixth highest-grade global underground mine and a top 5 global producer of antimony.

SXG considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its Mandalay Technical Report, 2022 dated 25 March 2022. The gold equivalence formula used by Mandalay Resources was calculated using recoveries achieved at the Costerfield Property Brunswick Processing Plant during 2020, using a gold price of US$1,700 per ounce, an antimony price of US$8,500 per tonne and 2021 total year metal recoveries of 93% for gold and 95% for antimony, and is as follows: 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%).

Based on the latest Costerfield calculation and given the similar geological styles and historic toll treatment of Sunday Creek mineralization at Costerfield, SXG considers that a 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Sunday Creek.

About Mawson Gold Limited (TSXV:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited has distinguished itself as a leading Nordic exploration company. Over the last decades, the team behind Mawson has forged a long and successful record of discovering, financing, and advancing mineral projects in the Nordics and Australia. Mawson holds the Skellefteå North gold discovery and a portfolio of historic uranium resources in Sweden. Mawson also holds 51% of Southern Cross Gold Ltd. (ASX:SXG) which owns or controls three high-grade, historic epizonal goldfields covering 470 km2 in Victoria, Australia, including the exciting Sunday Creek Au-Sb discovery.

About Southern Cross Gold Ltd (ASX:SXG)

[email=https://www.southerncrossgold.com.au/]Southern Cross Gold[/email] holds the 100%-owned Sunday Creek project in Victoria and Mt Isa project in Queensland, the Redcastle and Whroo joint ventures in Victoria, Australia, and a strategic 10% holding in ASX-listed Nagambie Resources Limited (ASX:NAG) which grants SXG a Right of First Refusal over a 3,300 square kilometer tenement package held by NAG in Victoria.

On behalf of the Board,

"Michael Hudson"

Michael Hudson, Interim CEO and Executive Chairman

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Further Information

www.mawsongold.com

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary

+1 (604) 685 9316

info@mawsongold.com

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, Mawson’s expectations regarding its ownership interest in Southern Cross Gold, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including COVID-19, on the Company’s business, risks related to negative publicity with respect to the Company or the mining industry in general; exploration potential being conceptual in nature, there being insufficient exploration to define a mineral resource on the Australian-projects owned by SXG, and uncertainty if further exploration will result in the determination of a mineral resource; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson’s most recent Annual Information Form filed on SEDAR. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()