Highlights

- Diamond drilling completed, with 1,619m drilled in 12 holes – positive results validate the original Newmont drilling.

- Ongoing RC drilling has proven a 400m extension to the southwest of the current resource area, providing strong potential to add tonnage to the existing Indicated Resource.

- Geotechnical drilling programme successfully completed with four drillholes in the proposed pit walls totalling 670m – a report is expected from the consultants shortly.

- Initial crushing and screening testwork results are very encouraging, confirming initial analysis that most tin will be liberated via a simple coarse crush.

- Final, end to end mineral processing results are expected by the end of June.

- A preliminary report has shown that low carbon power generation is most attractive from both an economic and social licence perspective – in line with the Company’s core values.

- A large amount of data has been collected for the Environmental Impact Study and is being assessed – no red flags have been identified by the work completed to date.

First Tin CEO Thomas Buenger said, “First Tin has made considerable progress over the last six months and the project is shaping up well. No red flags have been identified to date and we are pleased to confirm that results so far underpin our previous hypotheses. The drilling has confirmed the previous Newmont results and has also extended the known mineralisation by approximately 400m to the south. Infill drilling will now be undertaken with the aim of creating new Indicated Resources in this area so they can be included in the Feasibility Study.

“Most data collection is planned to be completed and results received by the end of June when some major decisions concerning the size and style of operation will be finalised and the Feasibility Study can progress from that point forward with a single option. This data collection includes all drilling and assaying, mineral processing testwork on the 0.19% sample and variability crushing testwork on the lower grade drill core material.

"Despite experiencing significant cost inflation on most workstreams First Tin is still on track, and fully financed, to complete the Feasibility Study and the Environmental Impact Study by the end of 2023 and we look forward to sharing more results as they come to hand.”

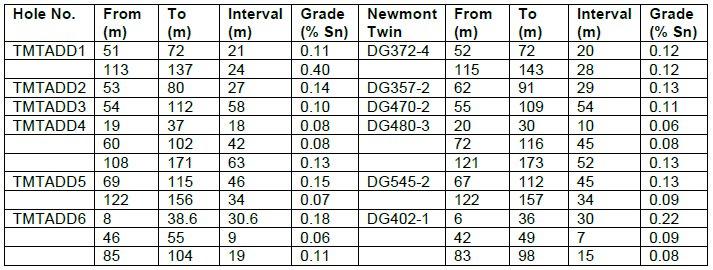

Diamond drilling has now been completed with a total of 1,619m drilled in 12 holes. This was designed to twin previous Newmont drillholes in order to confirm the validity of that data. Details of the drilling are shown in Figure 3 and in the table below.

These results show that the agreement between TMPL and Newmont drillholes is generally very good except for one interval in TMTADD1 which returned a much higher average in the TMPL drillhole than the original Newmont drillhole, DG372-4. On close inspection, it is evident that several veins of very coarse cassiterite (tin-oxide mineral) occur in that interval, with one 2m zone averaging 2.36% Sn. This would have skewed results and explains the discrepancy.

RC Drilling

RC drilling is currently underway with 2,435m completed to date – 1,957m of infill and extension drilling completed in 13 drillholes and 478m twin drilling completed in four drillholes.

Results have been received for the extension drilling and have previously been reported to market on 27 January 2023. This has resulted in the mineralisation being extended approximately 400m south of the previous Newmont resource area, with better results including (downhole widths):

- 41m @ 0.20% Sn from surface

- 22m @ 0.12% Sn from 62m

- 19m @ 0.20% Sn from surface

- 9m @ 0.20% Sn from 133m

- 32m @ 0.28% Sn from 118m

- 33m @ 0.18% Sn from 109m

- 56m @ 0.12% Sn from 5m

The drill rig is now infilling this area with the aim of adding tonnage to the Company’s existing Indicated Resource.

Drilling has also been undertaken in an area previously assumed to be barren, in the centre of the Newmont resource area. To date, results have been received for one drillhole, TMARC015 (Figure 3), which returned several zones of tin mineralisation (downhole widths):

- 11m @ 0.20% Sn from 24m

- 5m @ 0.15% Sn from 91m

- 3m @ 0.19% Sn from 115m

- 6m @ 0.08% Sn from 123m

This result confirms that tin mineralisation continues in this previously assumed barren zone and has enabled a revised geological interpretation of the mineralisation as being semi-continuous across this zone as shown on Figure 3.

Geotechnical Drilling

The geotechnical drilling programme has been completed with four drillholes in the proposed pit walls totalling 670m. These holes have also been fitted with piezometers and will be used to measure groundwater levels in the proposed pit areas. The holes have been geotechnically logged and a report on the stability of pit walls and recommended pit slopes is expected from the consultants shortly.

Water Monitoring Bores

A total of 300m has been drilled in six holes in order to monitor groundwater levels within the greater project area. Piezometers have been installed and will be used to monitor groundwater levels on a regional basis.

Mineral Processing Testwork

Crushing and screening testwork on the sample taken from the main adit has now been completed at ALS Perth and the resulting upgraded product has been sent to ALS Burnie for further downstream mineral processing testwork.

The head grade of the sample tested was 0.19% Sn and results of the crushing and screening stage are very encouraging, with approximately 82% of the tin recovered within 46% of the mass while the Sn grade increased to 0.36% Sn. While this confirms the Company’s initial analysis that most tin will be liberated via a simple coarse crush, this still requires confirmation by the variability sample results on lower grade material.

In that regard, samples of lower grade material have been selected from drill core for variability testing and a suite of samples with head grades between 0.062% Sn to 0.150% Sn have been sent for further crushing testwork at ALS Perth.

Further mineral processing at ALS Burnie (on both the 0.19% and on the lower grade samples) will consist of spiral and jig testwork followed by grinding down to 0.75mm, spiral and shaking table separation, further grinding down to 0.30mm and then finally a sulphide flotation and gravity clean-up stage to produce a final saleable concentrate. The Company expects to receive final, end to end mineral processing results on the 0.19% sample in H1/ early H2.

Lidar and Orthophoto Survey

A Lidar and Orthophoto survey was commissioned via Measure Australia and undertaken in late 2022. Results have now been received and are being used for the ongoing feasibility studies. The data provided is to a 0.2m horizontal and 0.1m vertical accuracy. Outputs include a digital elevation model (DEM), digital terrain model (DTM), orthophoto and contours at 0.25m interval.

The DTM removes the effects of vegetation and the difference between the DEM and DTM can be clearly seen on Figures 1 and 2. This will enable accurate placement of all facilities required for the mine infrastructure.

Alternative Energy Studies

A preliminary report into the best power options has shown that low carbon power generation is most attractive from both an economic and social licence perspective and fits with the Company’s core values. Several proposals have been obtained from companies specialising in evaluating, designing, and building alternative energy power supplies and the Company is currently close to signing a contract with one of these parties.

Taronga has several advantages when looking into these options including:

- Freehold land ownership of around 25km2 area

- High solar capacity factor (~21%)

- Good wind speed characteristics (~7.8m/s at 150m, capacity factor of ~40%)

- Location within the New England Renewable Energy Zone (REZ), one of NSW’s priority REZs

- Within 7km of 11 kV powerline and 11km of 330 kV power line

Water Studies

A review of water options for the project has been undertaken and it appears likely that the use of groundwater will be the best option available. To this end, the Company has undertaken a regional study of potential aquifers and has identified several viable targets for water exploration bores. Exploration water drilling is planned in the coming weeks and bore-field establishment will begin once water has been confirmed.

First Tin has also purchased an allowance (via auction) of 636-unit shares (a unit share is around 1 megalitre per year) from the NSW Governments controlled water allocation scheme (Controlled Allocation Order (Various Groundwater Sources) 2022, gazetted on 14 October 2022). This should be

more than sufficient for the project needs going forward and represents a substantial preventive risk mitigation measure for the project.

Environmental Impact Study

Environmental impact assessments at the Company’s Taronga asset are well underway with the Spring/Summer biodiversity surveys complete and the Autumn/Winter surveys in preparation. Heritage surveys are also planned for the next few months while soil surveys have been completed and show that no major undesirable impacts are likely.

Traffic surveys have also highlighted no major issues, with current transport corridors being sufficient for our needs. Waste characterisation work is ongoing, however initial studies suggest the waste rock is likely to be non-acid forming, although more work is needed to confirm this. Rejects from processing are still to be tested. Surface water, air quality, social/community and noise surveys are also ongoing.

In summary, a large amount of data has been collected and is being assessed, and no red flags have been identified by the work completed to date.

DFS

As data is still being collected, in particular drilling results, geotechnical data and mineral processing testwork results, the feasibility study has focussed on trade-off studies and data collection to date.

The main work areas are currently:

- Geotechnical testwork and reporting

- Rock properties

- Product and reject specifications and handling

- Site layout and operational plan

- Throughput analysis

- Owner-operator versus contract mining

- Preliminary plant designs

- Preliminary mine designs

- Waste rock and tailings disposal site analysis and verification

- Power supply options

Results will be reported as they are received for each of these work streams.

Enquiries:

First Tin

Via SEC Newgate below

Thomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt

020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell

020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Axaule Shukanayeva /

Molly Gretton

07900 248 213

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()