- Gold Measured and Indicated Mineral Resources increased by 20% to 1.35 million ounces

- Gold Inferred Mineral Resource increased by 34% to 1.05 million ounces

- Gold Proven and Probable Mineral Reserve increased by 12% to 538,000 ounces

Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) ("Karora" or the "Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/) is pleased to announce Gold Measured and Indicated (“M&I”) Mineral Resource, net of depletions, at its flag ship Beta Hunt Mine has increased by 20% and the Inferred Mineral Resources have increased by 34%. The update is highlighted by the net additions to the Western Flanks zone of 146,000 ounces in Measured and Indicated Resources and 338,000 ounces of Inferred Mineral Resources. Gold Proven and Probable Reserves also increased by 12%, or 56,000 ounces, to 538,000 ounces. Both resources and reserves have an effective date of September 30, 2022.

Paul Andre Huet, Chairman & CEO, commented: "During our 2022 drilling campaign, we were squarely focused on expanding our resource inventory at Beta Hunt, with significant step out and infill drilling completed to bring potentially mineralized zones identified via exploration drilling into the resource categories. We were very successful in our efforts, with major contributions to both Measured and Indicated and Inferred Resources, increasing by 20% and 34%, respectively.

The bulk of our mined tonnes and ounces at Beta Hunt are currently sourced from Western Flanks, our largest mineralized shear zone. In 2022, we significantly expanded this zone both along strike and at depth, resulting in a 19% increase in Measured and Indicated Resources and an increase of 77% in Inferred Resources at Western Flanks, net of mining depletion. The large primary shear zone has now been delineated to a strike length of 1.8 kilometres and over 550 metres down-dip but still remains open at depth providing significant potential for further expansion.

Our success in expanding the Beta Hunt Mineral Resource is a critical step in continuing to feed an extended mine life as we increase production rates over the next couple years. Once the expanded Beta Hunt mining capacity is fully ramped up to its targeted capacity of 2 Mtpa, approximately 80% of our mill feed will come from our flagship Beta Hunt mine.

While we remained focused on turning exploration into Inferred resources over the last two years, I am also very pleased to announce a 12% increase to the Beta Hunt Gold Proven and Probable Reserve. Our new Reserve adds 56,000 ounces, net of mining depletions of approximately 164,000 ounces, compared to our prior estimate. Our new increased total of 538,000 ounces positions us well for many years of mining ahead as we continue to expand our resources and convert resources to reserves. In 2023, we will be focusing both on upgrading Inferred Mineral Resources to the Measured and Indicated categories and on continued expansion of our Reserve base, net of mining depletions.

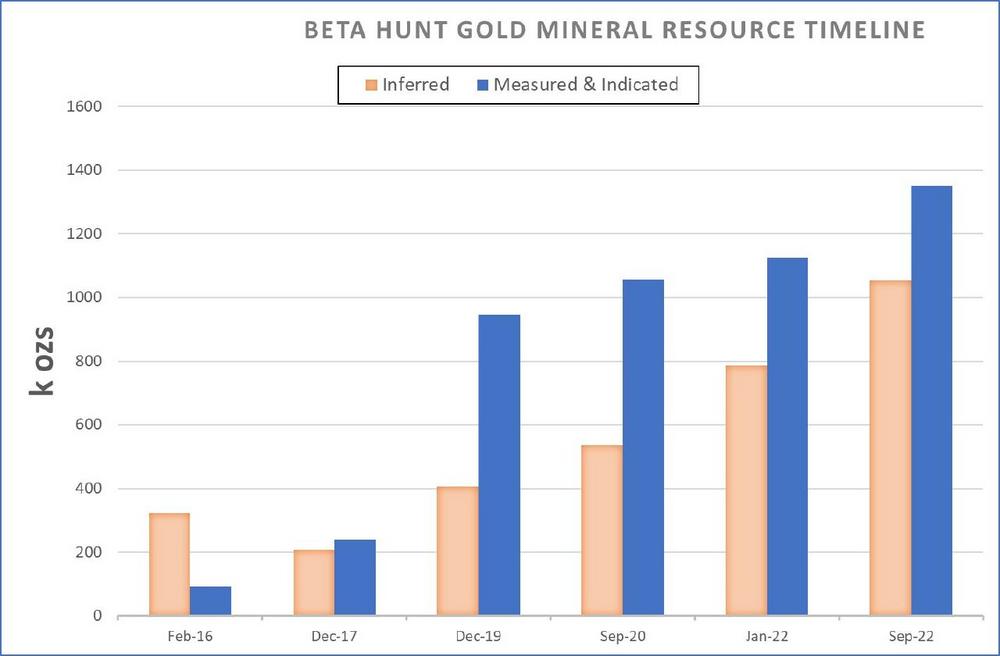

Beta Hunt is a very large system comprised of extensive, wide and continuous mineralized shear zones which have been extended both along strike and at depth. We have also discovered numerous parallel shear zones over the last several years including Larkin, Fletcher and now Mason and Cowcill. As can be seen in Figure 1, we have built a tremendous track record of continued resource growth via the drill bit at Beta Hunt with inventories rising over 500% since 2016. As we continue to execute on our aggressive underground drilling program in 2023, leveraging the +400km of extensive infrastructure already in place, we look forward to continued potential ounce additions supporting an extended mine life at Beta Hunt.”

Beta Hunt Gold Mineral Resource Summary

The updated Gold Mineral Resource is effective as of September 30, 2022 and represents an update to the previously released Beta Hunt Mineral Resource as of January 31, 2022 (see KRR release, April 7, 2022). The updated Indicated Gold Mineral Resource totals 1.35 million ounces, an increase of 20% (227,000 ounces). The updated Inferred Gold Mineral Resource now totals 1.05 million ounces, representing a 34% (266,000 ounces) increase. The result continues the trend of increasing Mineral Resources (Figure 1). The Beta Hunt Mineral Resource estimate is net of mine production depletion of 0.76 million tonnes grading 2.3 g/t for 56,000 ounces over the period February 1, 2022 to September 30, 2022 period.

The new Mineral Resource reflects the results from new drilling designed to extend and upgrade the January 31, 2022 Mineral Resource in support of the Karora Growth Plan which is underpinned by an expansion to 2.0 Mtpa mine production from Beta Hunt (see Karora news release, June 28, 2021). All three previously reported Mineral Resources comprising Western Flanks, A Zone and Larkin were updated. The location of all three resources is shown in Figure 2.

Western Flanks

At Western Flanks, resource definition and exploration drilling focused on upgrading the margins of the existing Mineral Resource and testing the down-dip extension of the mineralization. This work successfully extended the Mineral Resource up to 250 metres below the previous resource limit (see KRR news release, dated October 25, 2022) resulting in the zone contributing the bulk of the updated Mineral Resource increase. The Western Flanks Measured and Indicated Resources increased by 19% (143,000 ounces) and the Inferred Resource increased by 77% (338,000 ounces).

A Zone and Larkin

A Zone drilling concentrated on upgrading and extending the northern margin of the existing resource. This work resulted in the A Zone Measured and Indicated Resource increasing by 31% (72,000 ounces) and the Inferred Resource increasing by 9% (16,000 ounces).

Larkin drilling focused on upgrading the existing resource. This work resulted in the Larkin Measured and Indicated Resource increasing by 10% (12,000 ounces) with a decrease of 54% (88,000 ounces) in the Inferred Resource. The reduction in Inferred ounces at Larkin mostly reflects a geological re-interpretation of the north end of the resource which downgraded the size and grade of the previous interpretation based on new drilling data.

2023 Drilling Program

For 2023, gold drilling will be focused on upgrading Inferred Resources to Indicated status to provide the opportunity for increased Mineral Reserves. Significant exploration drilling is also planned to be undertaken targeting previously defined mineralized zones (Figure 3).

In the Hunt Block, exploration drilling is planned to test the along strike continuity of the Fletcher Zone and the northern up-plunge potential of A Zone. In the Beta Block, infill and extensional drilling of the Cowcill and Mason Zones is aimed at following up some of the recently reported drill intersections including 12 g/t over 17 metres and 6.0 g/t over 13.0 metres (See Karora news releases dated October 25 and August 25, 2022) with the aim of adding these mineralized zones to the Beta Hunt Resource Inventory.

Beta Hunt Mineral Reserve Summary

The updated Gold Mineral Reserve is effective as of September 30, 2022, and represents an update to the previously released Beta Hunt Mineral Reserve as of September 30, 2020 (see KRR release, December 16, 2020)

The updated Gold Mineral Reserve now totals 538,000 ounces, representing a 12% (56,000 ounces) increase from the, September 30, 2020, Mineral Reserve estimate.

The Beta Hunt Mineral Reserve is net of mine production depletion of 1.91 million tonnes grading 2.7 g/t for 164,000 ounces over the period October 1st, 2020, to September 30, 2022.

The 2022 Beta Hunt Reserve additions within the Western Flank and A Zone mine areas have replaced production depletions, with the new southern production area, Larkin, contributing to the increase in reserves with a maiden Proven and Probable Mineral Reserve of 719k tonnes at a grade of 2.5 g/t for 58,000 ounces.

Technical Report

The Beta Hunt Mineral Resource and Reserve estimate will be detailed in a technical report prepared in accordance with NI 43-101 to be filed under the Corporation’s SEDAR profile at sedar.com within 45 days of the date of this news release.

Compliance Statement (JORC 2012 and NI 43-101)

Mr. Stephen Devlin is Group Geologist for Karora, a full-time employee of Karora and a Fellow of the AusIMM. Mr Devlin has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr Devlin has reviewed and approved the disclosure of the technical information for the Beta Hunt Gold Mineral Resource included in this news release.

Shane McLeay is a mining engineer and a Fellow of the AusIMM. Mr McLeay is an employee of Entech Pty Ltd of Perth, Western Australia, who were employed by Karora to undertake the Gold Mineral Reserve estimate for Beta Hunt. Mr McLeay has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code, 2012 Edition, and fulfils the requirements to be a "Qualified Person" for the purposes of NI 43-101. Mr McLeay has reviewed and approved the disclosure of the technical information for the Beta Hunt Gold Mineral Reserves included in this news release.

The "JORC Code" means the Australasian Code for Reporting of Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Mineral Council of Australia. There are no material differences between the definitions of Mineral Resources under the applicable definitions adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM Definition Standards") and the corresponding equivalent definitions in the JORC Code for Mineral Resources.

Detailed Footnotes relating to Mineral Resource Estimates as at September 30,2022

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves.

- The Measured and Indicated Mineral Resources are inclusive of those Mineral Resources modified to produce Mineral Reserves.

- The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are applied.

- The Gold Mineral Resource is estimated using a long term gold price of US$1,675/oz with a US:AUD exchange rate of 0.70.

- The Gold Mineral Resource is reported using a 1.4g/t Au cut-off grade.

- Beta Hunt is an underground mine and to best represent “reasonable prospects of eventual economic extraction” the mineral resource was reported taking into account areas considered sterilized by historical mining. These areas were depleted from the Mineral Resource.

- Mineral Resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

Detailed Footnotes relating to Beta Hunt Mineral Reserve Estimates as at September 30, 2022

- The Gold Mineral Reserve is estimated using a long-term gold price of US$1,450/oz with a US:AUD exchange rate of 0.70.

- At Beta Hunt, underground Mineral Reserves are reported at a 1.8 g/t cut-off grade. The cut-off grade takes into account Operating Mining, Processing/Haulage and G&A costs, excluding capital.

- The Mineral Reserve is depleted for all mining to September 30, 2022.

- Mineral Reserve tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

About Karora Resources

Karora is focused on increasing gold production to a targeted range of 185,000-205,000 ounces by 2024 at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. In July 2022, Karora acquired the 1.0 Mtpa Lakewood Mill in Western Australia. At Beta Hunt, a robust gold Mineral Resource and Reserve are hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. The Corporation also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to, among other items, production guidance, the organic growth profile and the potential of the Beta Hunt Mine and Higginsville Gold Operation, the Aquarius and Two Boys Projects, Spargos Gold Mine and Lake Cowan prospect.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ‘s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()