In order to effectively counteract churn and achieve conquests, it is essential to recognise trends and interrelationships as well as to segment the buyer structure according to age, purchase modality and gender. Dwindling loyalty is a particular challenge, leading to marketing and product level needing to become more targeted. The reality right now is every second person changes brands when buying a car. For the purpose of this press release Dataforce choose 3 brands to touch on – Dacia, Mercedes and Mazda.

The loyalty analysis

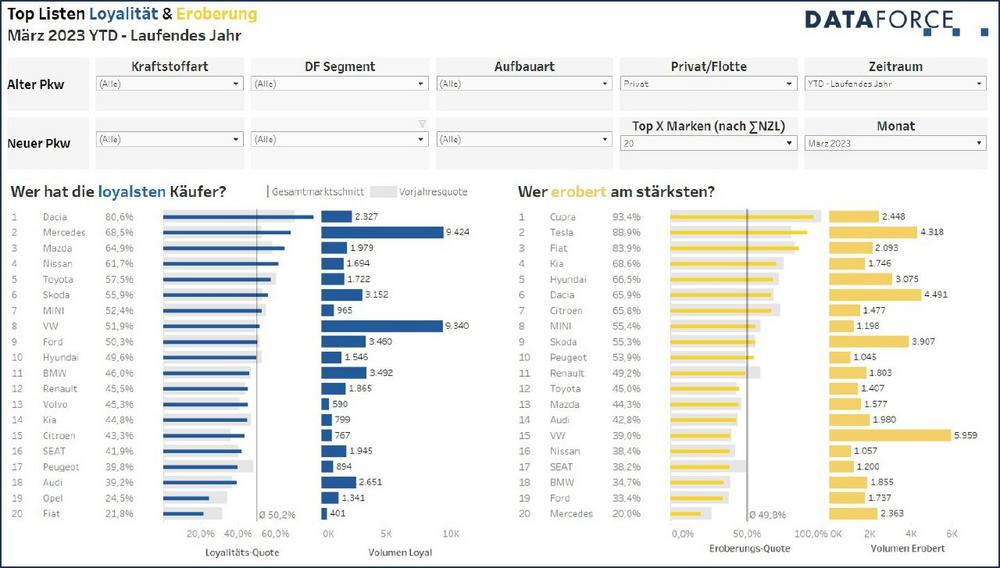

Firstly, it makes sense to define loyalty. For this purpose, Dataforce examines vehicle changes i.e. If a car buyer chooses the same brand again, they are loyal. If they switch to another brand, the clientele is deemed to have been conquered. Loyalty and conquests can be measured in absolute terms (how many customers were retained or won in total) and also relative to the previous (loyalty) or current (conquests) new registrations of the brand.

In relative terms of loyalty for the first quarter of 2023, Dacia is in first place with 81%, followed by Mercedes with 70% and Mazda with just under 65%. Measured in absolute terms, Mercedes is in first place with 9,340 loyal customers, while Dacia "only" has 2,327 loyal buyers.

The churns are people who choose another brand when they change their vehicle. In the case of Dacia, where loyalty is relatively high, there are few churns. With a share of 5%, most switch to Renault, thus staying with the group, though 1.3% each of former Dacia customers opt for Skoda and VW. While for former Mercedes buyers who decide to buy another brand, almost 10% buy from the VW group.

Conquests

Let’s now see from whom the three brands were able to capture new buyers in the first quarter of 2023. Among all the people who chose Dacia, 10% came from the VW brand and almost 9% from Renault customers. Accordingly, Dacia has a positive balance of churn and conquest to these manufacturers.

In comparison, Mercedes recruits about 9% of new registrations from former customers of the Wolfsburg group. On balance, therefore, the Stuttgart based company is losing slightly.

Mazda did relatively well in terms of conquests and, interestingly, was also able to conquer customers among the high-priced manufacturers. For example, from VW’s share it was 6%, BMW’s and Mercedes’ were 3% each and for previous Audi buyers just under 3%.

DATAFORCE – Wir zählen Autos.

As a leading market research company, we bring transparency to the European automotive market. Independent – with over 25 years of experience – we set standards and make markets comparable.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-381

Fax: +49 (69) 95930-382

E-Mail: Mert.kurnaz@dataforce.de

![]()